Empowering Your Journey Toward

Smarter Home Loan Solutions

Welcome to Keystone Home Loans

Your Trusted Mortgage Partner

At Keystone Home Loans, we understand that navigating the competitive and ever-changing mortgage landscape can be overwhelming. That's where we come in. We are dedicated to helping you find the right loan, tailored to your unique financial situation.

We're here to simplify the process, negotiating on your behalf to secure the best terms and loan features available. Our mission is to make your experience as smooth and stress-free as possible, delivering fast results while helping you avoid common pitfalls along the way.

Whether you're buying your first home, refinancing, or investing in property, we'll provide the guidance you need, empowering you to make informed and confident decisions. Let Keystone Home Loans find the perfect solution to suit your personal circumstances and financial goals.

Your Goals, Our Commitment

ACCESS TO OVER 50 LENDERS

We work with Australia's leading financial institutions to ensure you have access to the most competitive rates and loan products available in the market.

OUR PROCESS IN 3 KEY STEPS

Understand your goals

We meet with you to learn more about you, understand your needs and overall goals based on your financial situation

Provide you with some options

We carefully construct and present tailored loan options to suit your needs and provide a recommendation on the most suitable option

Get it sorted for you – hassle free

From application to settlement, we manage the paperwork and keep you informed every step of the way - empowering you to make smarter home loan decisions.

How Can We Help You?

Buying a home is a big decision, and having the right support can make all the difference. We understand that purchasing a home is one of the most important steps in your life, and we're here to make sure you have all the information and options you need to find the perfect finance solution for the home you want.

With so many home loan choices out there – plus new ones being introduced all the time, along with special deals and offers – it can feel overwhelming. That’s where we come in. As your trusted broker, we’ll help you find a loan that fits your needs, guide you through the paperwork, and handle the application process for you.

No matter where you are on your home-buying journey, we’re here to empower your journey towards smarter home loan solutions.

Feel free to reach out by phone or email – we’re always happy to help make the process easier.

Buying your first home is an exciting milestone, but it can also bring up a lot of questions and decisions. One of the first things you’ll need to know is how much you can borrow and what your repayments will be. That’s where we come in. We’ll do the hard work for you by comparing home loan options from Australia’s top lending institutions to find the right fit for your needs.

As a first home buyer, you might also be eligible for a first home buyer grant. This grant is available to Australian citizens or permanent residents who are buying or building their first home, which they plan to live in within 12 months of settlement.

Since the grant conditions can vary by state, reach out to us, and we’ll help you understand the eligibility requirements and how much you could receive. We’ll also work directly with the lender on your behalf, so you can focus on finding the perfect home.

From application to approval, we’ll be with you every step of the way, guiding you through the entire home loan process.

As life evolves, so do your financial needs. Maybe you've switched jobs, welcomed a new family member, or simply want a better rate. Perhaps school fees are on the horizon, the kids have moved out, or that leaking shower or outdated kitchen is finally taking its toll.

When your circumstances change, it’s the perfect time to revisit your home finances.

Refinancing your mortgage may seem overwhelming, with factors like fees and the choice between fixed and variable interest rates to consider. But the right refinanced loan can help you pay off your mortgage faster, reduce your debt, or even upgrade and add value to your home. It’s all about making your financial situation work better for you—and we’re here to help you take the next step in the right direction.

Investing in property requires research and the right support. With recent shifts in the share market and tight rental conditions, many investors are turning to property as a stable, long-term investment.

While property typically follows a 7-10 years cycle, it remains a solid choice thanks to the housing shortage and tax benefits like negative gearing. However, securing financing can be more challenging in today’s cautious lending environment. That’s where we come in—we help you find the right lender and loan, so you can focus on finding the perfect property.

Navigating SMSF loans can feel complicated, especially with strict lending criteria, rules, and the need to balance your superannuation fund’s long-term growth with securing the right property. This is where a mortgage broker becomes invaluable.

The right SMSF loan could help you grow your wealth, create a stable retirement plan, or even unlock the potential to expand your property portfolio. But refinancing or securing an SMSF loan isn’t always straightforward.

That's why working with us means taking the guesswork out of the equation, so you can focus on the bigger picture and feel confident in your SMSF investment decisions.

When it comes to securing a commercial loan, the right financing can make all the difference to your business’s growth and success.

Whether you're purchasing a new property, expanding your operations, or refinancing an existing loan, navigating the complexities of commercial lending can be challenging.

As expert mortgage brokers, we’re here to simplify the process for you. We’ll work closely with you to understand your business goals and tailor a loan that fits your specific needs.

With access to a wide range of lenders and loan products, we can find the best rates, terms, and structure to suit your situation.

Commercial loans can involve different terms, security requirements, and interest rate structures compared to residential loans. Our knowledge of the commercial lending landscape ensures we’ll find the right solution for your business—saving you time, money, and unnecessary stress.

Let us take the complexity out of securing your commercial loan, so you can focus on what matters most—growing your business and achieving your goals.

Building your dream home or starting a new construction project is an exciting venture, but it requires the right financial support to bring it to life.

A construction loan is designed to help fund your project from start to finish, with flexible payment structures that cater to your unique needs.

As expert mortgage brokers, we’re here to help you secure the best construction loan for your project. Whether you're building a new home, adding an extension, or undertaking a large-scale commercial development, we’ll guide you through the entire loan process. From securing competitive interest rates to managing the disbursement of funds as your project progresses, we ensure your construction journey is as smooth as possible.

With access to a wide range of lenders and loan options, we’ll help you find the ideal loan terms, repayment structures, and financing solutions for your specific project. Plus, we’ll be with you every step of the way, ensuring your construction loan is set up to match your timeline and budget.

When you're in between properties—whether you're upgrading your home, relocating, or buying before selling—a bridging loan can provide the financial flexibility you need. It helps cover the gap between buying your new property and selling your current one, ensuring you don’t miss out on your dream home while waiting for your sale to go through.

Keystone Home Loans specialises in helping you navigate the complexities of bridging loans. We’ll work with you to find the best loan product that fits your needs, with flexible terms and competitive rates. Whether you need short-term financing or are looking for a seamless transition between homes, we’re here to make the process simple and stress-free.

Bridging loans can be tricky to navigate, with different structures and repayment options to consider. Our team will guide you every step of the way, ensuring you secure the right financing solution with minimal disruption to your plans. Let us take the guesswork out of securing your bridging loan, so you can focus on moving forward with confidence.

Whether you're looking to upgrade your car, invest in new equipment, renovate your home, or extend your business operations, the right loan can help turn your plans into reality. But with so many loan options out there, it can be overwhelming to choose the best one for your needs.

We have access to a wide range of lenders, meaning we can help you find the perfect loan for your unique situation—whether it’s securing a competitive interest rate or structuring your repayments to suit your budget. Plus, with our expertise, we can guide you through the application process, ensuring everything runs smoothly from start to finish.

Let us help you get the right loan for your next big step—whether it's upgrading your car, expanding your business, or making your home dreams a reality.

Phillip is a an accredited Mortgage Broker and Full Member of the Mortgage & Finance Association of Australia

Trading as Keystone Home Loans Pty Ltd ATF BEMA Family Trust

Credit Representative Number 564704 is authorised under Australian Credit Licence Number 384704

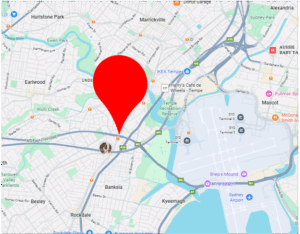

Where is Keystone Home Loans located?

Keystone Home Loans is proudly based in Arncliffe, NSW.

Whether you’re based locally or overseas, we’re here to help – partnering with clients across Australia and around the world to achieve their property goals.